Explore the latest changes in Pakistan’s real estate tax and their impact on property prices. Learn about CGT, FED, and Advance Income Tax implications for buyers and sellers.

Pakistan Real Estate Tax 2024-25: Will prices rise or fall? The visionary

The Pakistani real estate market is undergoing significant changes with the introduction of new tax policies for the financial year 2024-25. These changes, particularly by affecting capital gains tax (CGT), federal excise duty (FED), and advanced income tax, are expected to impact property prices and investment behavior.

Capital Gains Tax (CGT):

Previously, CGT for properties sold within 6 years of purchase was subject to a sliding scale from 15% to 2.5%. However, the government has imposed a flat rate of 15% for both filers and non-filers, irrespective of the holding period. This change will particularly affect individuals who have held properties for more than 6 years, as they will now pay 15% tax regardless of the profits.

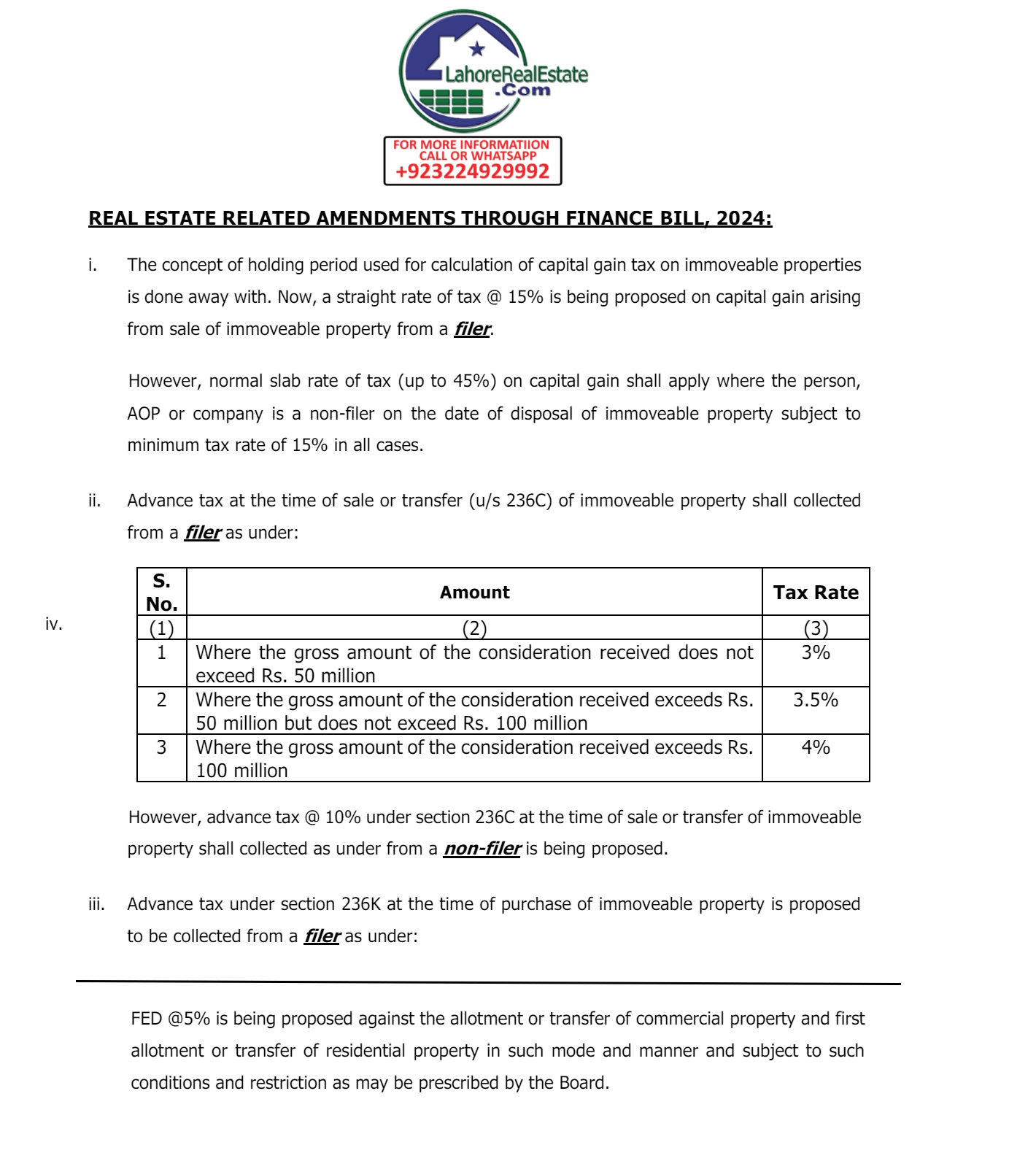

The latest budget proposals for the year 2024-2025 have made significant changes in real estate and property taxation. These changes are aimed at streamlining the tax system and encouraging compliance among taxpayers. Here’s a detailed look at the proposed changes to help you understand how they may affect your real estate transaction.

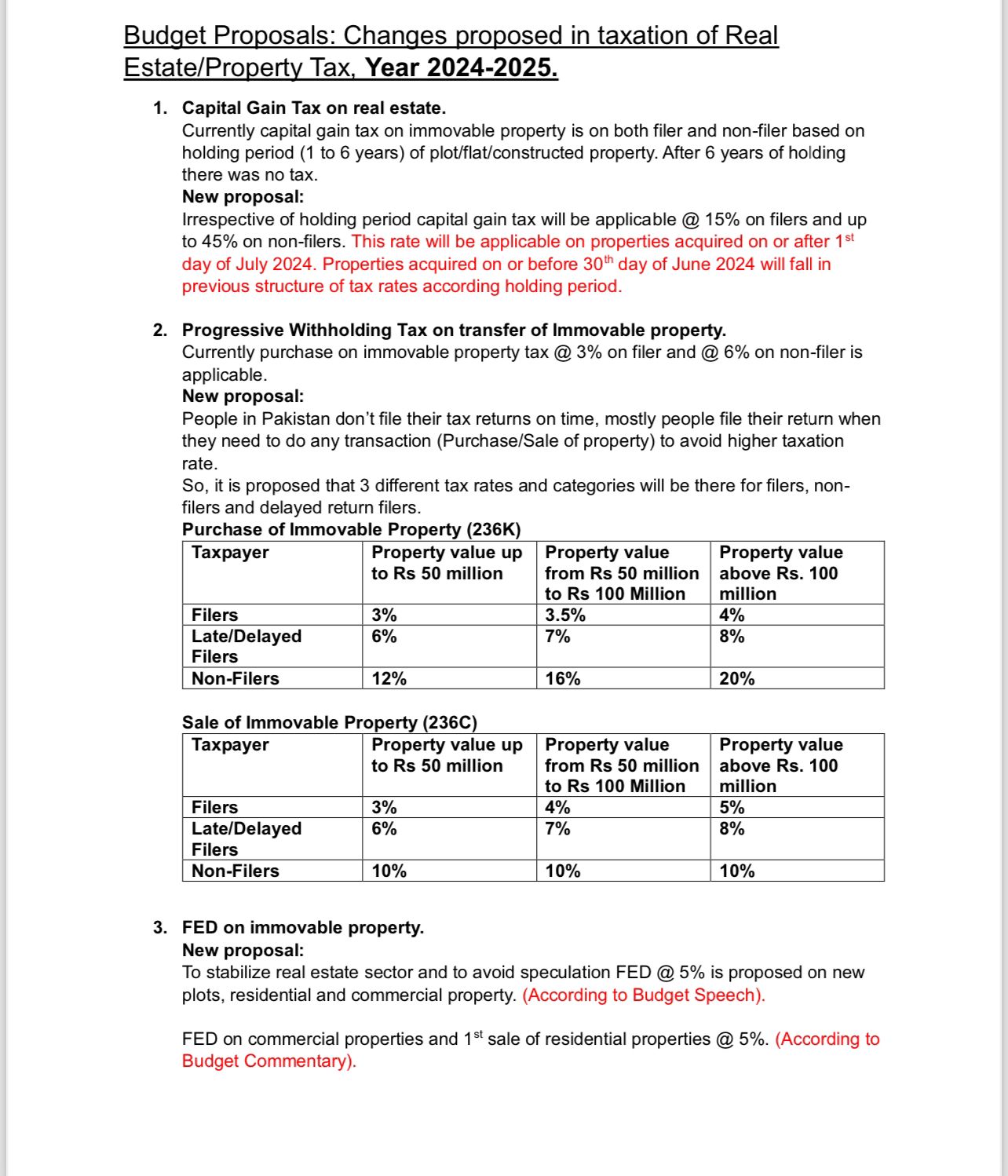

1. Capital Gains Tax on Real Estate

Currently, capital gains tax on immovable property is applicable to both filers and non-filers based on holding period (1 to 6 years) for plots, flats and constructed property. After 6 years of holding there was no tax.

New proposal

- Uniform application of tax: Regardless of the holding period, capital gains tax will now be applicable at 15% for filers and 45% for non-filers.

- Effective Date: This rate will be applicable for properties acquired on or after 1 July 2024.

- Previous Acquisitions: Properties acquired on or before June 30, 2024 will follow the previous tax structure based on holding period.

2. Progressive withholding tax on transfer of immovable property

Currently, the tax on purchase of immovable property is 3% for filers and 6% for non-filers.

New proposal

To tackle the problem of late tax returns, new progressive withholding tax rates have been proposed:

- Filers:

- Property value up to Rs 50 million: 3%

- Property value from Rs.50 million to Rs.100 million: 3.5%

- Property value above Rs 100 million: 4%

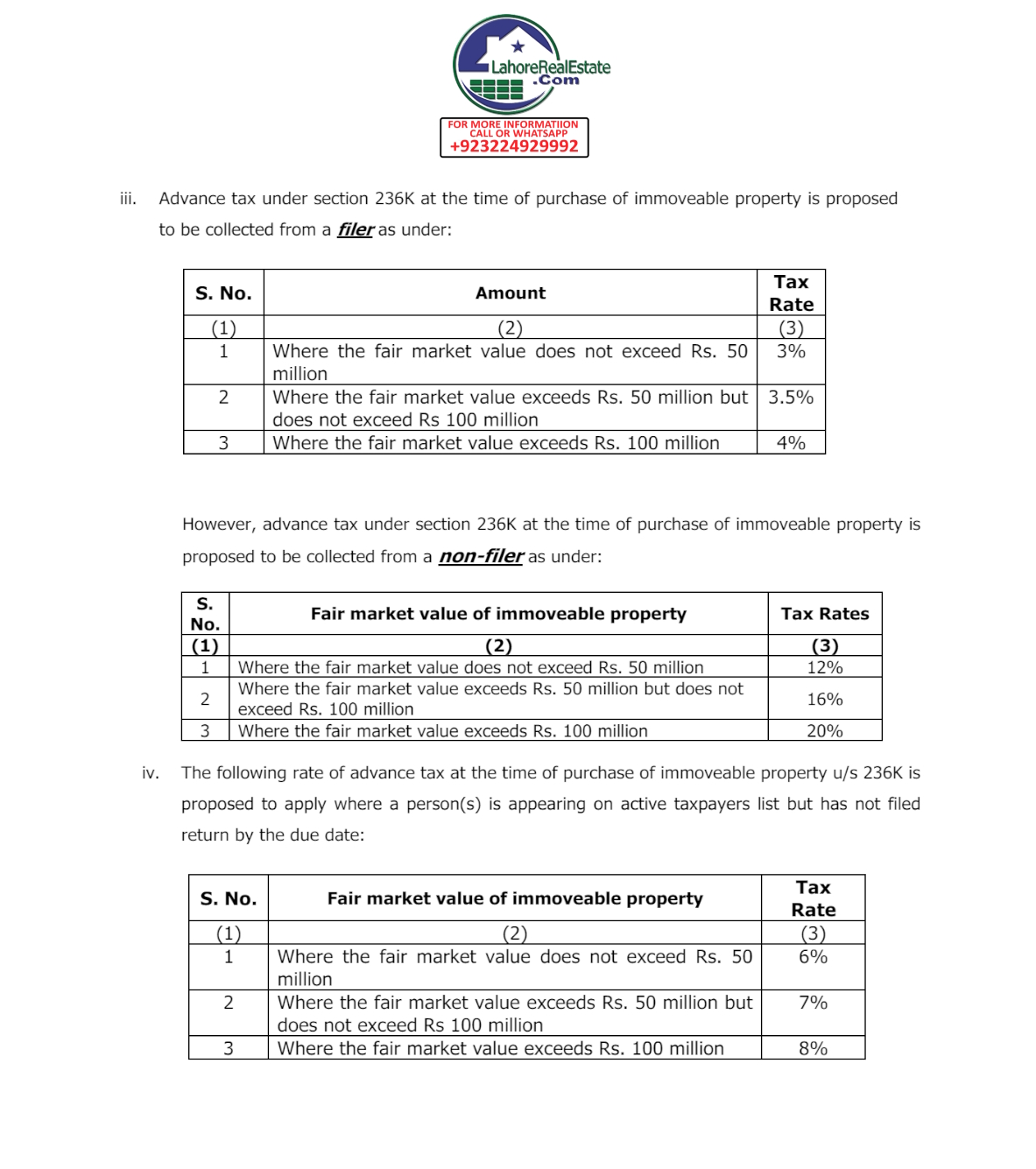

- Late/Delayed Filers:

- Property value up to Rs 50 million: 6%

- Property value from Rs.50 million to Rs.100 million: 7%

- Property value above Rs 100 million: 8%

- Non-filers:

- Property value up to Rs 50 million: 12%

- Property value from Rs.50 million to Rs.100 million: 16%

- Property value above Rs 100 million: 20%

Sale of immovable property

- Filers:

- Property value up to Rs 50 million: 3%

- Property value from Rs.50 million to Rs.100 million: 4%

- Property value above Rs 100 million: 5%

- Late/Delayed Filers:

- Property value up to Rs 50 million: 6%

- Property value from Rs.50 million to Rs.100 million: 7%

- Property value above Rs 100 million: 8%

- Non-filers:

- A uniform rate of 10% irrespective of the value of the property

3. FED on immovable property

New proposal

To stabilize the real estate sector and curb speculation, a Federal Excise Duty (FED) of 5% on new plots, residential and commercial property is proposed.

- First sale of commercial properties and residential properties: 5% FED will be applied.

Pakistan Real Estate Tax 2024-25: How does it impact the property market?

The proposed real estate tax changes for 2024-2025 are aimed at creating a more streamlined and harmonized tax environment. These changes include significant adjustments to capital gains tax, progressive withholding tax, and introduction of FED on immovable property. Property buyers, sellers, and investors should keep abreast of these updates to make well-informed decisions.

Impact on Real Estate Market:

Changes in tax policies are expected to have a mixed impact on the real estate market. While the flat CGT rate and increase in advance income tax for non-filers may dampen market activity initially, the government’s intention to encourage filer compliance and reduce tax evasion will lead to transparency and long-term stability. can become

key points:

- The new tax policies are aimed at increasing revenue and encouraging tax compliance.

- The impact on property prices will depend on the market’s response to the changes.

- Non-filers will face a significant financial burden due to CGT and advance income tax rates.

- Government efforts to streamline the real estate sector can lead to investment and market growth in the long run.

Non-filer Effect:

Non-filers will face significant tax implications, as they will be taxed as per the income tax bracket. Their CGT can range from 15% to 35% depending on their tax bracket. This may prevent non-filers from engaging in real estate transactions, potentially affecting market activity.

Advance Income Tax:

Advance income tax changes vary depending on the status of the filer and the value of the property. 5 crore for properties below Rs., filers continue to pay 3% advance tax, while non-filers now pay 12% (up from 11%). 10 crore for properties above Rs., filers see a reduction of up to 4% (from 35%), while non-filers face an increase of up to 20% (from 16%).

Result:

Changes in Real Estate Tax Policies of Pakistan are important and will likely affect the market in both the short and long term. While some initial uncertainty and adjustment is expected, the government’s aim to create a more transparent and regulated market could ultimately benefit the real estate sector and the Pakistani economy.

Read more: https://lahorerealestate.com/?s=tax