What is new? Budget 2025 property deductions in purchase tax

The federal government has suggested, in Budget 2025 Largest I Advanced tax on the purchase of immovable property. The move is expected Restore the property of an unauthorized transaction And relieve real buyers and investors.

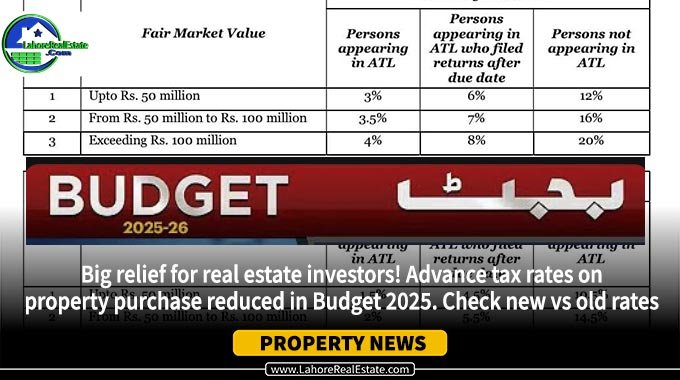

Here is an error Present And Proposed tax rates Based on Fair market value (FMV) ANd Tax filer status:

Current v

| Fair market price | Current rate (ATL) | The proposed rate (ATL) | Change |

|---|---|---|---|

| Up to Rs. 50 million | 3 % | 1.5 % | 🔻 50 % lower |

| RS. 50-100 million | 3.5 % | 2 % | 🔻 less |

| 100 million above Rs. | 4 % | 2.5 % | 🔻 less |

For them To file after a fixed dateTax is high. And for Non -filersTax is high to discourage non -documentary investment:

| Fair market price | Proposed tax (late filers) | Proposed tax (non -filers) |

|---|---|---|

| Up to Rs. 50 million | 4.5 % | 10.5 % |

| RS. 50-100 million | 5.5 % | 14.5 % |

| 100 million above Rs. | 6.5 % | 18.5 % |

Why is it important to real estate investors

-

✅ ✅ Low entry cost: A major reduction in tax means easy access to high value features.

-

✅ ✅ Encourages ATL’s compliance: A huge tax difference between ATL and non -ATL buyers encourages to file tax declarations.

-

✅ ✅ The market enhances leukemicity: Low taxation will encourage purchase and sale, especially premium places such as DHA, Bahria Town, Lake CityAnd Lahore Smart City.

https://www.youtube.com/watch?v=u6wrwlk1i4y

Practical Example: Buying in DHA Lahore Phase 8

If you are buying a commercial plot price RS. 100 million In 2025:

Key notes for buyers and sellers

-

These are Proposed rates And can affect after approval.

-

Filing on time is more important than ever before Double or triple tax burden.

-

For Builders and investorsIt’s the right time Enter the market before prices rise After the implementation.

The final views

The proposed tax deduction is one in Budget 2025 Positive action For the real estate sector of Pakistan. Whether you are buying personal use or investing for rent income or capital profit, reduction of tax rates Cheaper and raising profits.